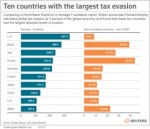

Tax Justice Network: U.S. is country with largest tax evasion Why Are Nannies Having a Harder Time Finding Great Jobs? The results of the Be the Best Nanny Newsletter monthly poll show that nannies blame illegal immigrants working at nanny jobs as the number one reason American citizens are having a hard time finding great nanny […]